Traders, nevertheless, must be conscious that competitors inherent in the forex market tends to appropriate worth discrepancies very quickly as they appear. As a outcome, the emergence of such alternatives may be fleeting—at the same time as brief as seconds or milliseconds. Because of this, anybody excited what is triangular arbitrage about adopting an arbitrage technique will need to be have a system in place to monitor the market intently throughout prolonged intervals in order to probably reap the benefits of such alternatives before costs transfer to find an equilibrium.

Mere existence of triangular arbitrage opportunities doesn’t necessarily indicate that a buying and selling technique looking for to use currency mispricings is consistently profitable. Electronic buying and selling methods allow the three constituent trades in a triangular arbitrage transaction to be submitted very quickly. However, there exists a delay between the identification of such a chance, the initiation of trades, and the arrival of trades to the get together quoting the mispricing. Even although such delays are only milliseconds in period, they are deemed vital.

Such variation in the half-lives of deviations may be reflective of differences in the degree of economic integration among the many country teams analyzed. RIRP doesn’t maintain over short time horizons, but empirical evidence has demonstrated that it typically holds nicely throughout long time horizons of 5 to ten years. By attempting to benefit from worth discrepancies, traders who have interaction in arbitrage are contributing in the direction of market efficiency. A classic example of arbitrage could be an asset that trades in two different markets at totally different costs—a clear violation of the “Law of One Price”.

A trader can profit from this mispricing by buying the asset at the market that offers the lower cost and promoting it back available on the market that buys at the greater worth. Such earnings, after accounting for transaction prices, will little doubt draw additional traders who will search to use the same worth discrepancy, and consequently, the arbitrage opportunity will disappear as the prices of the asset balances out throughout the markets. In phrases what is triangular arbitrage of worldwide finance, this convergence will result in purchasing power parity between totally different currencies. Theoretically, the costs on both exchanges must be the same always, but arbitrage alternatives arise when they’re not. In concept, arbitrage is a riskless activity because merchants are simply buying and selling the identical amount of the identical asset on the same time.

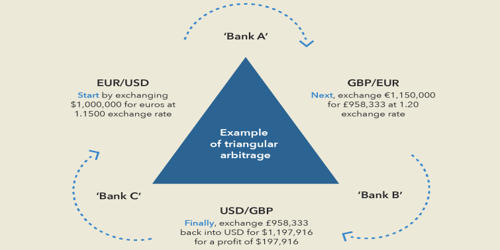

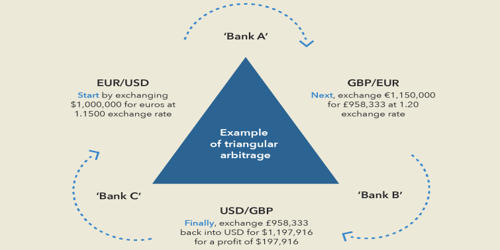

For example, if a dealer places every commerce as a limit order to be stuffed solely on the arbitrage price and a price moves as a result of market exercise or new price is quoted by the third party, then the triangular transaction won’t be accomplished. In such a case, the arbitrageur will face a price to close out the place that is equal to the change in value that eradicated the arbitrage condition. This type of arbitrage can also be called cross-forex or three-level arbitrage, and the strategy involves recognizing value discrepancies in three different currencies trading on the FX market. The opportunity arises when the quoted exchange fee of a forex varies from its implied cross exchange rate, leading to considered one of them to be overpriced and the other underpriced. Arbitrage opportunities may arise much less incessantly in markets than some other profit-making opportunities, however they do appear once in a while.

Arbitrage trading is a chance in monetary markets when related belongings can be purchased and bought simultaneously at completely different prices for revenue. Simply put, an arbitrageur buys cheaper belongings http://bigshotrading.com/ and sells dearer belongings at the identical time to take a profit with no net money flow. In principle, the practice of arbitrage should require no capital and involve no threat.

Why is covered interest arbitrage covered?

Ans: The increase in the US interest rate leads to an upward shift of the UIP curve, and an outward shift of the IS curve. The depreciation thus leads to an increase in output and the domestic interest rate.

In apply, however, attempts at arbitrage generally contain both capital and risk. Arbitrage happens when a safety is bought in a single market and simultaneously bought in one other market at a better worth, thus thought-about to be danger-free profit for the dealer. Arbitrage provides a mechanism to make sure prices do not deviate substantially from truthful value for long durations of time. With developments in expertise, it has turn into extremely troublesome to profit from pricing errors out there.

Uncovered Interest Rate Parity Vs Covered Interest Rate Parity

- Some worldwide banks function market makers between currencies by narrowing their bid-ask unfold greater than the bid-ask spread of the implicit cross change rate.

- Using weekly information, they estimated transaction prices and evaluated their function in explaining deviations from rate of interest parity and located that the majority deviations might be defined by transaction prices.

- The alternative to earn riskless income arises from the truth that the interest rate parity condition doesn’t continually maintain.

- When spot and forward change price markets aren’t in a state of equilibrium, buyers will not be detached among the obtainable interest rates in two nations and can put money into whichever currency offers the next price of return.

- Frenkel and Levich concluded that unexploited opportunities for revenue don’t exist in lined interest arbitrage.

- However, accommodating transaction prices didn’t clarify noticed deviations from coated rate of interest parity between treasury bills within the United States and United Kingdom.

Triangular arbitrage is the results of a discrepancy between three foreign currencies that happens when the forex’s change charges do not exactly match up. These alternatives are uncommon and traders who take advantage of them usually have advanced computer tools and/or applications to automate the method. The dealer would exchange an quantity at one price what is triangular arbitrage (EUR/USD), convert it once more (EUR/GBP) and then convert it lastly again to the original (USD/GBP), and assuming low transaction prices, internet a profit. The use of triangular arbitrage could be an efficient method to take earnings when market circumstances allow, and incorporating it into one’s playbook of methods may enhance probabilities for positive aspects.

Is Forex A arbitrage?

Arbitrage refers to the practice of simultaneously buying and selling an investment in order to profit from a difference in price. Essentially, arbitrage can exist because of inefficiencies in the market, and if an arbitrage is found, it can be a risk-free way to earn a profit.

The threat arises from the fact that the future spot trade fee for the currencies isn’t recognized with certainty when the technique is chosen. Their empirical analysis demonstrates that positive deviations from coated interest %url% rate parity indeed compensate for liquidity and credit score danger. After accounting for these risk premia, the researchers demonstrated that small residual arbitrage profits accrue only to those arbitrageurs able to negotiating low transaction costs.

Economists, in fact, contemplate arbitrage to be a key factor in sustaining fluidity of market circumstances as arbitrageurs help bring costs throughout markets into balance. When the no-arbitrage situation is happy with using a ahead contract to hedge towards publicity to exchange price danger, interest rate parity is said to be coated. Furthermore, coated interest rate parity helps clarify the dedication of the ahead exchange rate.

The parity condition suggests that actual rates of interest will equalize between countries and that capital mobility will lead to capital flows that remove opportunities for arbitrage. There exists strong evidence that RIRP holds tightly amongst emerging markets in Asia and also Japan. The half-life interval of deviations from RIRP have been examined by researchers and found to be roughly six or seven months, but between two and three months for certain countries.

Example Of An Arbitrage Trade

The primary concept of arbitrage is to buy an asset while concurrently promoting it (or a substantially equivalent asset) at a better worth, taking advantage of the distinction. Since the transactions happen on the identical time, there isn’t any holding period, therefore this can be a threat-free revenue technique.

Covered Interest Arbitrage

Many traders have computerized trading methods set to observe fluctuations in related financial devices. Any inefficient pricing setups are usually acted upon quickly, and the opportunity is usually eliminated in a matter of seconds.

What causes arbitrage?

Covered interest arbitrage. Covered interest arbitrage is an arbitrage trading strategy whereby an investor capitalizes on the interest rate differential between two countries by using a forward contract to cover (eliminate exposure to) exchange rate risk.